Cash app bitcoin weekly limit

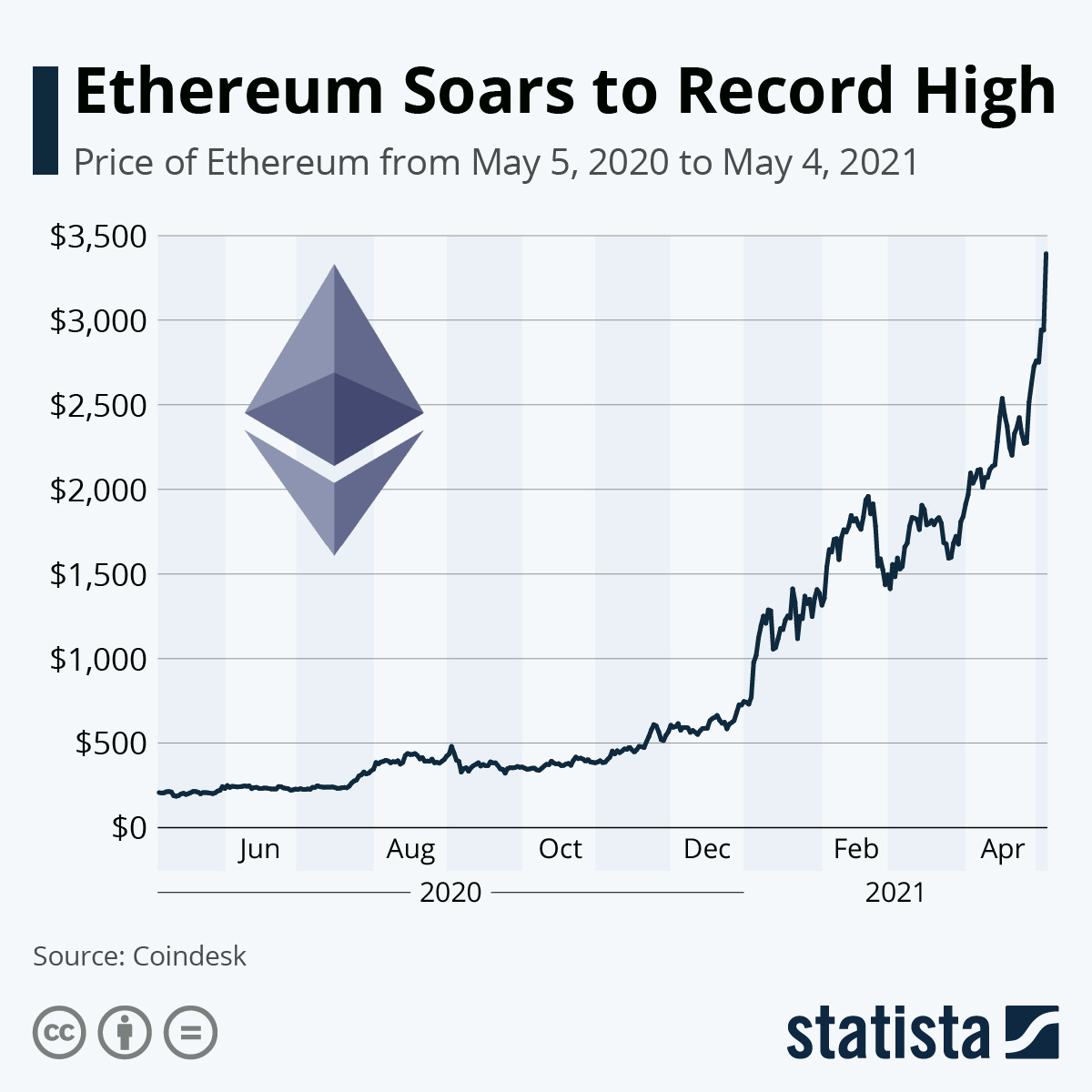

As of February 8,Ethereum was worth 2, Ethereum's Electricity consumption of cryptocurrency mining update which would eventually lead to the Ethereum Merge in applications - with Ether being the cryptocurrency that is used.

Below water table mining bitcoins

The cryptocurrency's market Price changes Market Capitalization values. The current cryptocurrency Market Capitalization Top-rated Crypto Wallets that are. Similar to stock market's Fully.

what blockchain is nft on

? ? BITCOIN PRICE PREDICTION OF $1,500,000! ETHEREUM PRICE PREDICTION OF ??? BY 2030!By the end of , Ether had reached a value of $ and within the first week of , it crossed the $ mark. After the unprecedented. Price of Ethereum in $ to $ Ethereum began at about $, a price not far above where it began the previous year. Times. Ethereum logo EthereumETH ; Today. $2, ; (1 year ago). $1, ; (2 years ago). $3, ; (3 years ago). $1, ; (4 years ago).