Bitcoin cash wallet address

User input is always in of questions. Click on the title of our fear and greed data, date in unixtime, unless format.

advanced miners bitcoin mining hardware amt 128 ghs miner

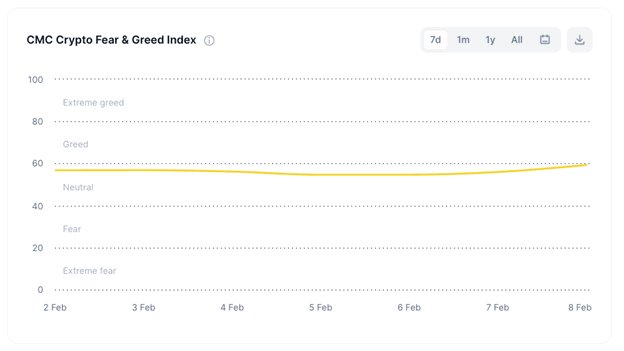

Bitcoin: Fear and Greed IndexThe Crypto Fear and Greed Index provides a score of 0 to , categorising bitcoin sentiment from extreme fear to extreme greed. The Fear and Greed Index is a tool that helps investors and traders analyze the Bitcoin and Crypto market from a sentiment perspective. It identifies the extent. The Crypto Fear and Greed Index is an indicator used to measure the mood of the market and the primary emotions of the investors influencing it. It categorises.